Address

No 09-5/1, Station Road, Colombo 04, Sri Lanka

Work Hours

Monday to Friday: 8.30 AM - 5 PM

When seeking to attract new investors, increase your ownership stake, or even exit a company, one crucial step to take is the issuance or transfer of shares. Of course, there are numerous scenarios in which adjustments to your shares may be necessary.

For instance, during the registration process, you may consider issuing initial shares, or alternatively, transferring existing shares to other shareholders. However, the precise procedures for these actions can be somewhat intricate. Regrettably, many businesses lack awareness regarding the laws and regulations that govern such processes. As a result, confusion and inefficiency often prevail within companies.

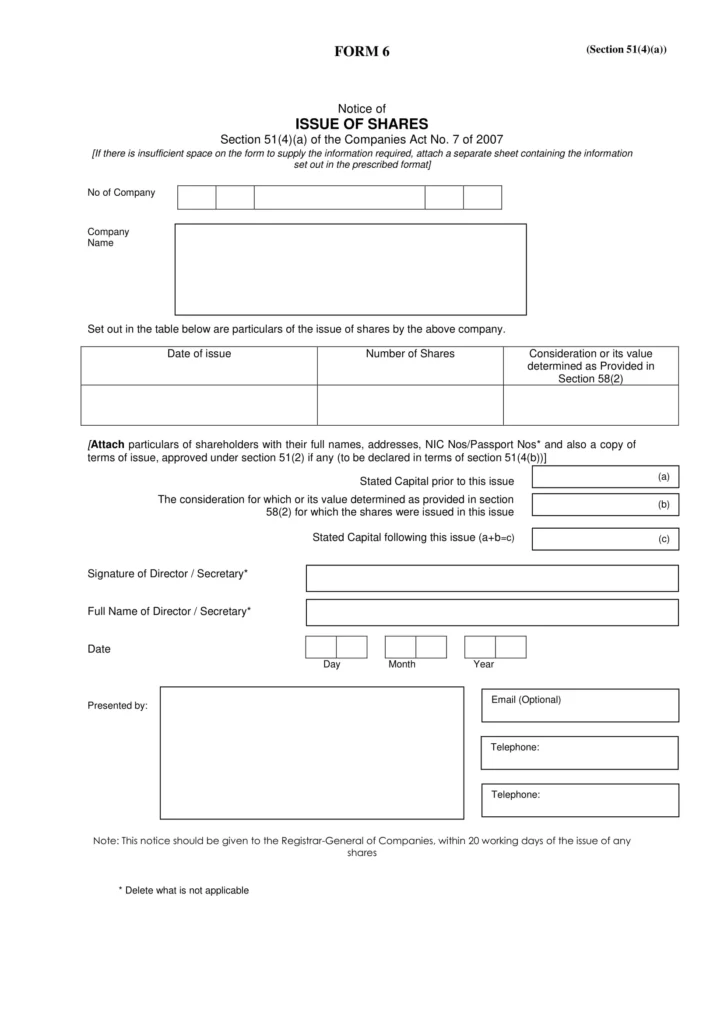

If you find yourself in the position of needing to issue or transfer shares in your Private Limited Company, this comprehensive guide is tailored to assist you. It will provide detailed instructions on issuing shares using Form 6, as well as transferring shares through a designated “Share Transfer Form”.

Let’s commence this informative journey. The collective expertise of our team has been instrumental in contributing significantly to the development of this article.

In order to address this inquiry, it is important to first grasp the concept of a share.

Consider a share as a fractional ownership of a company. Company owners typically divide their organization into small units, which are then offered for sale in exchange for monetary value. When you acquire one or more of these units, you become a partial owner of the company. The funds obtained from the sale of shares are utilized by companies to foster their growth.

Both Private Limited Companies and Public Limited Companies issue shares, although there is a distinction between the two. Private Limited Companies restrict the issuance of shares to a limited number of specific buyers, whereas Public Limited Companies make their shares available to the general public through the stock market.

Individuals who possess these “shares” are referred to as shareholders. As a token of their investment, shareholders receive periodic payments known as “dividends.”

Here are some reasons why shareholders may decide to make a share transfer

As part of the company registration procedure in Sri Lanka, your company will undergo an initial share issuance. This requirement stems from the fact that a minimum of one shareholder is necessary when establishing a Private Limited Company.

To fulfill this requirement, your company issues shares for the first time through Form 1, which is a mandatory step typically managed by either yourself or your company secretary.

Following the initial share issuance, there may arise a need to issue additional shares for your company. This is commonly done to attract new investors to the company. However, this process involves a distinct set of procedures.

The specific process we will discuss in this blog pertains to the issuance of additional shares beyond the initial issuance.

The process of issuing shares can be divided into three key steps:

Step 01: Convene a board meeting

Step 02: Pass a board resolution

Step 03: Submit the necessary documentation

Let’s delve into each step in greater detail:

Initiate the share issuance process by arranging a meeting with the company’s board of directors.

During this meeting, important decisions need to be made, including:

Determining the quantity of shares to be issued.

Establishing the price per share.

Deciding whether to issue shares of the same class or higher, which determines the voting and distribution rights of new shareholders.

Once the number of shares to be issued is determined, it is crucial to pass a board resolution. This resolution serves as evidence that the entire board of directors has approved the share issuance, and it will be filed with the Registrar of Companies (ROC).

Key Considerations

Next, let’s explore the process of communicating this information to the ROC.

To initiate a share issue, it is necessary to file Form 06 with the ROC. You can download all the necesssary forms from the ROC website here

After a company’s share issue, several actions need to be taken:

Within a span of 20 days following the share issue, a notice must be submitted to the ROC. This notice should include the following details:

Certification of Form 06:

Upon verifying that all documents are in order, the ROC will endorse Form 06 and provide a certified copy. It is crucial to possess this stamped copy as it demonstrates the validity and legality of the share issue, which is significant for institutions such as banks.

By completing these procedures, you ensure compliance and establish the legitimacy of your company’s share issue.

PASS A BOARD RESOLUTION

To transfer shares, you require approval from the board of directors. This is done by organizing a meeting, discussing the transfer, and passing a board resolution. Once approved, shares can be transferred and the ROC must be notified.

FILE ALL THE RELEVANT DOCUMENTS

To transfer shares, complete the Share Transfer Form and board resolution accurately. Send the forms to the Registrar of Companies for processing to avoid delays.

CANCEL THE OLD SHARE CERTIFICATE (OPTIONAL)

You can also cancel the share certificate of the transferee.

CREATE A SHARE TRANSFER AGREEMENT (OPTIONAL)

1. The particulars of the party transferring the shares.

2. The particulars of the party receiving the shares.

3. The conditions and terms governing the transfer.

4. The valuation of each share at the time of the transfer.

5. The quantity of shares being transferred.

ISSUE A NEW SHARE CERTIFICATE

Once the shares have been transferred, you have to issue new share certificates to both the transferor and transferee

Issuing or transferring new shares in a company can be a lot of work, with a lot of paperwork to fill out, process, and submit. But you don’t have to deal with the hassle yourself. We are a registered company secretary with over 20 years of experience helping businesses with their share issues and transfers. We can help you with all the paperwork, including:

Get in touch with us to learn how to setup your business and let us take care of your administrative responsibilities