Address

No 09-5/1, Station Road, Colombo 04, Sri Lanka

Work Hours

Monday to Friday: 8.30 AM - 5 PM

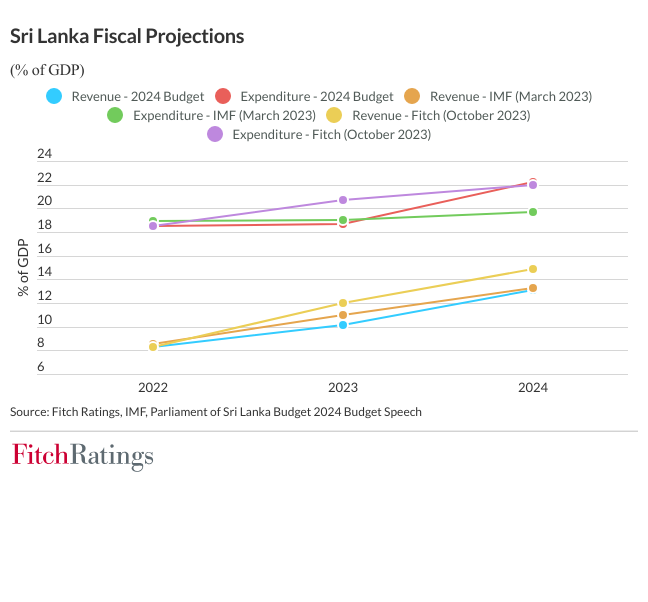

The article outlines the challenges facing Sri Lanka’s budget for 2024, as assessed by Fitch Ratings. It highlights the discrepancies between the government’s fiscal targets and IMF projections, emphasizing the uncertainties in revenue generation and increased spending plans. Fitch Ratings underscores the risks associated with meeting ambitious revenue goals, potential adjustments in spending, ongoing governance reforms, and the critical need for a commercial debt restructuring to normalize Sri Lanka’s relationship with the international financial community. This summary is based on information provided by Fitch Ratings in their article on Sri Lanka’s budget challenges for 2024. The collective expertise of our team has been instrumental in contributing significantly to the development of this article.

Targets and Deficit:

IMF Projections vs. Budget:

Financing and Revenue Risks:

Government Spending and Potential Adjustments:

Reform Efforts and Rating:

Future Outlook:

Key Points in Detail:

Challenges in Meeting Fiscal Targets:

IMF Projections versus Government Targets:

Uncertain Revenue Generation and Risks:

Increased Spending and Potential Adjustments:

Governance Reforms and Revenue Collection:

Fitch Rating and Future Outlook:

Get in touch with us to take care of your processes allowing you more time to focus on what matters.