Address

No 09-5/1, Station Road, Colombo 04, Sri Lanka

Work Hours

Monday to Friday: 8.30 AM - 5 PM

Sri Lanka’s economy is on the path of recovery and taxes will be playing a crucial role this year. Our team of tax experts has gathered the top five tax stories to keep all our business leaders and stakeholders informed about the exciting developments taking place. By staying up-to-date with the latest changes in the business world, we can stay ahead of the competition and seize new opportunities that come our way. You too can benefit from this invaluable resource, so don’t miss out on this amazing opportunity to stay informed and motivated as we pave the way towards a brighter and better future for all.

President Ranil Wickremesinghe has unveiled a 2024 budget that sets sail for ambitious shores. He envisions a 47% surge in tax revenue compared to 2023, a lofty objective that raises both eyebrows and anxieties. Analysts view this goal as potentially perilous, especially in the wake of upcoming elections. Why? Meeting these targets hinges on securing the next tranche of the International Monetary Fund (IMF) loan, a lifeline for Sri Lanka’s economic recovery. Failure to comply, however, could leave the nation stranded in choppy financial waters, delaying the loan and straining the already turbulent fiscus.

The recent wave of tax increases, including a 18% VAT rate, a corporate income tax bump to 30%, and additional levies on trusts and non-profits, has stirred public anxieties about rising living costs. While a robust tax system is crucial for national buoyancy, the perception of a one-sided, burden-laden boat leaves many citizens feeling like bailing water. Striking a delicate balance between generating revenue and ensuring public affordability will be a critical test for the government’s navigation skills.

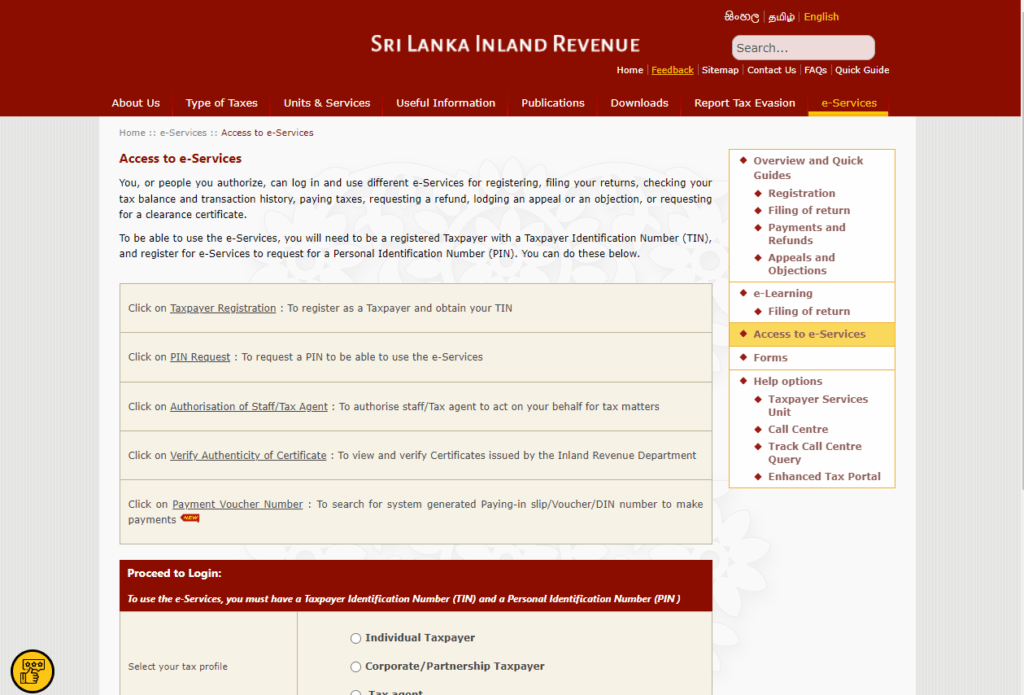

To make things more efficient and fair, the government is taking things online. Imagine filing your taxes on your phone instead of waiting in long lines! This “e-filing” feature could also help catch people who aren’t paying their fair share. But will everyone get onboard? Not everyone has a smartphone or stable internet access to use these features. The government needs to make sure everyone can sail through this digital storm. You can register your TIN here

Revised Tax Rates: Key Changes You Should Know The amendment...

Read MoreSmart tax management is essential for business success. It ensures...

Read MoreDespite initial directives mandating all individuals above 18 years to...

Read MoreTo attract foreign investors and breathe life into the economy, the government is introducing tempting anchors – in the form of targeted tax incentives for specific industries and infrastructure projects. These incentives could lure lucrative galleons laden with investment to Sri Lanka’s shores. However, crafting an investment climate that is both fiscally responsible and investor-friendly requires a delicate equilibrium. Finding the right mix of tax cuts and revenue generation will be essential to avoid sailing into the treacherous waters of fiscal instability.

In addition to current concerns, there are talks about upcoming tax reforms. These include changes to the income tax system, simplifying brackets, and possibly introducing progressive taxation. These reforms could alter the financial landscape, ensuring a fairer distribution of the tax burden and potentially stabilizing the economy. However, it’s crucial to strike a balance between tax reliefs and generating revenue. Time will tell if the government can navigate this situation effectively. For now, that’s the latest on the ongoing tax-related news.

Don’t forget to register for TIN by January 31, 2024, to avoid penalties. After the deadline, the government will enforce new laws, leading to automatic TIN registration with a hefty Rs.50,000 fine. We’re also offering manual TIN Registration directly from the IRD for those facing issues on the website or wanting to skip the hassle. Act fast to avoid penalties as it’s a limited-time offer.

Get in touch with us to take care of your processes allowing you more time to focus on what matters.